RBI Decides To Maintain Status Quo, Repo Rate Unchanged At 6.5 per cent

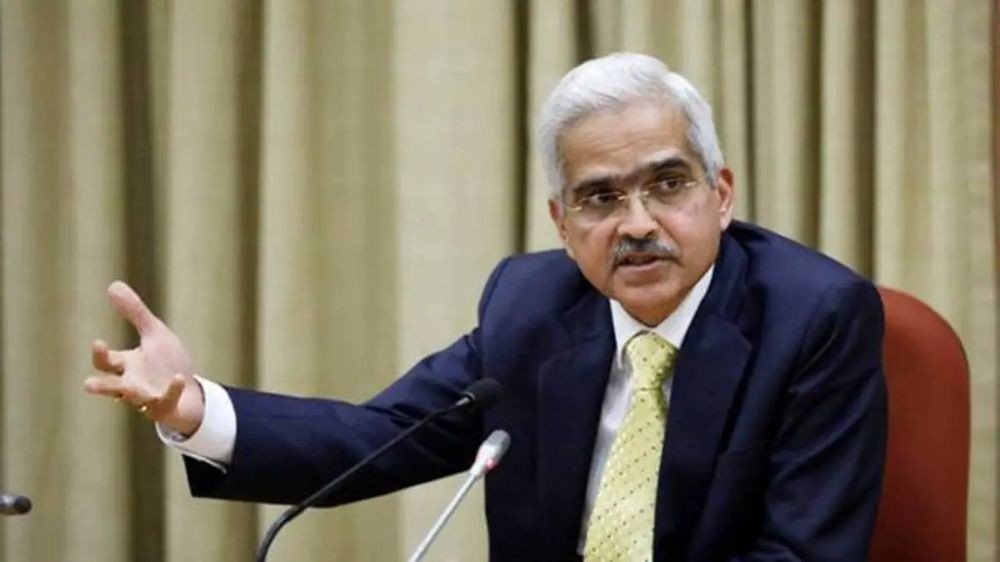

The Monetary Policy Committee on Thursday decided to keep the policy repo rate unchanged at 6.5 per cent, the Reserve Bank of India Governor Shaktikanta Das said after three days of deliberation.

“MPC also decided by a majority of five out of 6 members to remain focused on withdrawal of accommodation to ensure inflation aligns with the target while supporting growth,” Das said.

He also said that standing deposit facility rate remained at 6.25 per cent, and marginal standing facility rate and bank rate remained unchanged at 6.75 per cent. He further said that MPC will take further monetary actions as required to keep inflation expectations firmly anchored.

The RBI governor also announced that headline inflation is expected to remain above 4 per cent throughout the 2023-24 fiscal. Further, flagging concern about inflation, he stated that there is a need for close and continued vigil on inflation and the central bank will also need to monitor the uncertainties around monsoon, international commodity prices and financial market volatility.

Commenting on the development, ASSOCHAM Secretary General Deepak Sood said RBI decision to keep the benchmark interest rates unchanged at 6.5 per cent is on the expected lines, adding that focus of the monetary policy is clearly on further taming inflation for a stable growth.

“While the Monetary Policy Committee remains focussed on withdrawal of accommodation to further rein in inflation, we are confident that the RBI would ensure that adequate liquidity is maintained in the banking system and credit growth remains robust,” Sood said.

Karthik Srinivasan, Senior Vice President, Group Head - Financial Sector Ratings, ICRA Ltd said that the banks are already permitted to set their own limits for borrowing in term money and a similar proposal for call and notice money borrowings will allow more flexibility to banks. With the current volatility in liquidity conditions banks can plan liquidity management better and the LCR requirements will ensure that dependence on call borrowing is under check.

Lakshmi Iyer, CEO-Investment & Strategy, Kotak Investment Advisors Limited said, “MPC decided to remain status quo in line with the street and our expectations. Given global macro headwinds still visible, the members did not feel appropriate to change their stance. It looks like the market wait for rate cuts just got longer, as we saw Canada policy makers announce a surprise rate hike. Key incoming data dependency will continue to be the order of the day. Policy maker guard rails remain. Bonds may continue its sideways movement and continue to track global bond yields specifically US treasuries.”

Suvodeep Rakshit, Senior Economist, Kotak Institutional Equities said, “The RBI remains cautious on the inflation trajectory especially as inflation will remain above the 4 per cent target for the foreseeable future. The RBI continues to estimate average inflation

slightly above 5 per cent for FY2024 and retained GDP growth at 6.5 per cent. We

believe there are some downside risks to growth. We believe that rate cuts will be contingent on significant divergence in growth-inflation prospects. We maintain our call that the RBI will be on an extended pause.”

Meanwhile, Marzban Irani, CIO - Debt , LIC Mutual Fund said, “We reiterate our views that investors should go as long as possible depending on risk appetite. Existing carry despite recent fall in yield continue to remain attractive and should not be missed out. Medium to Long Duration funds may be a preferred investment option for investors.”

As expected, RBI kept rate unchanged second time in a row. This act shifts bias to see rate reduction in future. The impact of monsoon on inflation will be key determinant of future interest rates expectations apart from what central bankers do globally. RBI governor reiterated intent of targeting MPC’s mandate of 4% inflation instead of 4-6% range clearly indicates that rate reduction by RBI will start once it sees clear path to 4% inflation. This means that rate reduction cycle may start later than expected may be in Q4 FY24 or Q1 FY25. Bhavik Thakkar ,CEO, Abans Investment Managers.